10 Best QuickBooks Integrations for Growing Businesses in 2025

Discover top QuickBooks integrations & add-ons to automate bookkeeping, streamline workflows & scale your business with seamless software connections.

Table of Contents

Introduction

Growing businesses quickly outgrow manual bookkeeping. That's why QuickBooks integrations have become essential for owners, finance teams, and fractional CFOs who want to save time, reduce errors, and build a scalable Finance OS. Integrating QuickBooks with other tools streamlines business accounting and helps automate accounting processes, making it easier to manage data and improve efficiency.

With hundreds of apps available in the QuickBooks ecosystem, businesses have extensive options to tailor their financial systems to specific needs. The right integrations don't just plug gaps—they create a connected ecosystem that automates workflows, centralizes data, and frees your team to focus on strategy.

If you're exploring how modern technology fits into the future of accounting, it's important to understand that strategic integration selection can transform your financial operations. Intuit Inc. provides QuickBooks and its add-ons, each designed to enhance financial operations and reduce manual processes.

Editor's note: These are editorial picks based on common SMB use cases; not sponsored.

Related guides

- Future of accounting software — Comprehensive guide to AI-powered accounting software and QuickBooks alternatives

- What comes after QuickBooks — Explore how businesses are moving beyond traditional accounting software limitations

- Automated bookkeeping vs QuickBooks Live — Compare AI-powered automated bookkeeping with QuickBooks Live services

- QuickBooks Live vs Bench vs AI — Detailed comparison of QuickBooks Live, Bench, and AI bookkeeping solutions

- AI finance tech stack — Build a modern finance tech stack with AI-powered tools for startups

Why QuickBooks Integrations Are Essential for Growth

Without proper integrations, QuickBooks often becomes a data silo—leaving teams to reconcile multiple systems by hand. This creates several challenges:

Manual work: Duplicate entry across apps and spreadsheets wastes valuable time and increases labor costs.

Errors and delays: Mismatched data between payroll, payments, and bank feeds creates reconciliation nightmares that slow month-end close.

Missed insights: Incomplete reporting across disconnected systems prevents timely decision-making and strategic planning.

With the right QuickBooks integration tools, businesses gain significant advantages:

Automation: Real-time syncing between tools eliminates repetitive data entry and speeds up processing.

Accuracy: Automated reconciliation reduces human error and improves financial data quality.

Scalability: Integrated workflows grow with your business without proportional increases in headcount or manual effort.

To maximize these benefits, choose solutions that integrate seamlessly with QuickBooks and align with your specific business needs and growth stage.

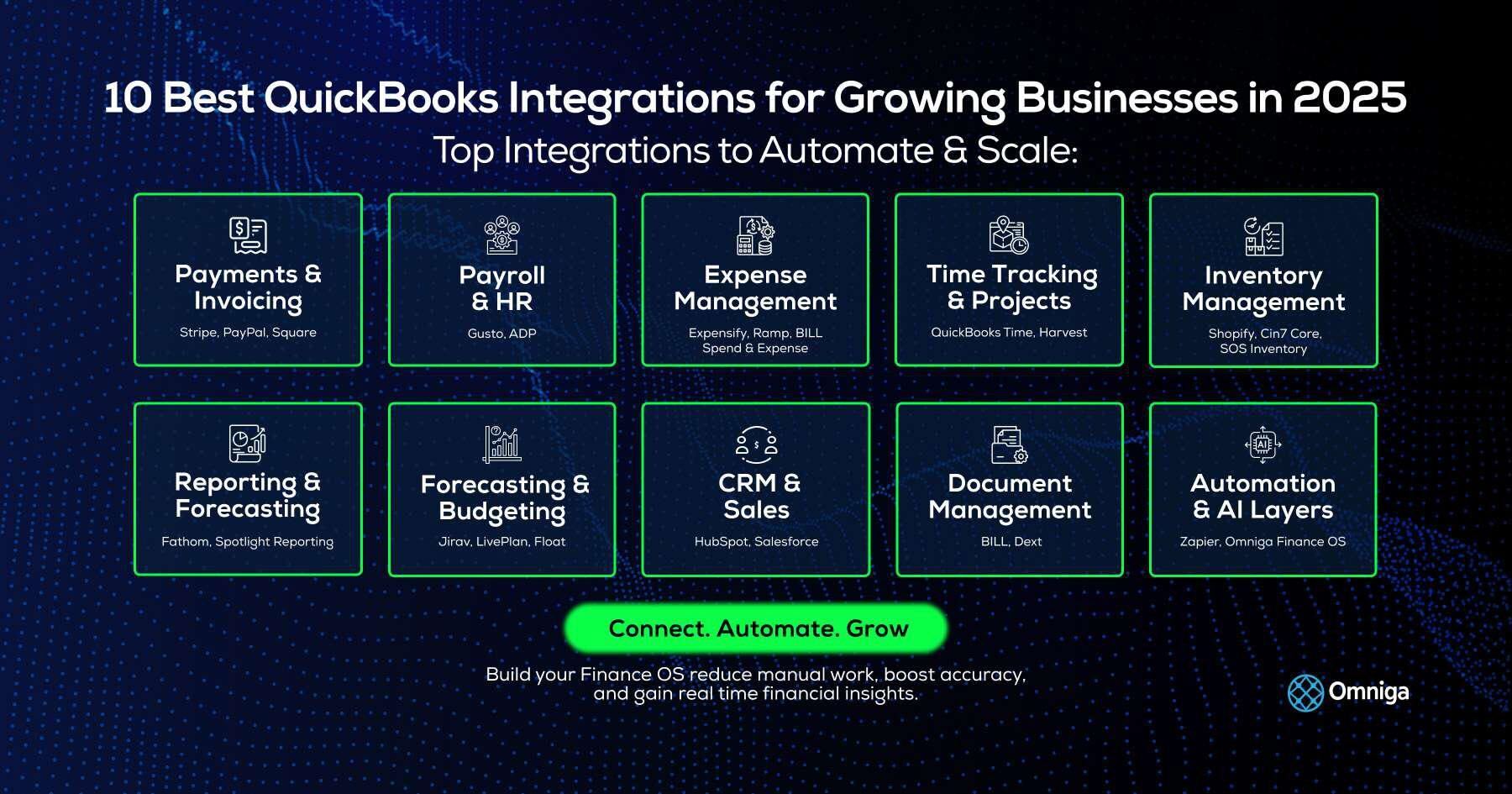

The 10 Best QuickBooks Integrations

Here are the must-have QuickBooks add-ons, grouped by function. These integrations allow you to connect QuickBooks software with other business tools, making it easy to sync with CRM systems, e-commerce platforms, and operational software. With these solutions, QuickBooks integrates seamlessly with hundreds of apps to streamline workflows and automate data sharing.

1. Payments & Invoicing: Stripe, PayPal, Square

Best for: Online businesses, service firms, retail operations, and subscription-based companies.

Why it matters: Get paid faster, create invoices directly from QuickBooks or the connected payment platform, and reconcile transactions instantly in your accounting system.

Setup note: Stripe offers robust recurring billing features and developer-friendly APIs, while Square excels for physical point-of-sale environments and retail locations.

2. Payroll & HR: Gusto, ADP

Best for: SMBs without dedicated in-house HR departments or those scaling rapidly.

Why it matters: Automates payroll processing, streamlines payroll management, handles tax filings, and syncs benefits administration. QuickBooks Payroll runs your payroll with current tax rates and calculates payments automatically, reducing compliance risks.

Setup note: Gusto's intuitive interface makes it popular with startups and small teams, while ADP scales better for larger organizations with complex payroll needs. QuickBooks Payroll integrates human resources, taxes, and health benefits into a comprehensive employee management solution.

3. Expense Management: Expensify, Ramp, BILL Spend & Expense

Best for: Teams needing real-time spend visibility, budget controls, and automated reimbursement processes.

Why it matters: Automates expense reporting, corporate card reconciliation, and approval workflows. Modern solutions like Dext Prepare automatically capture and organize receipts for streamlined expense management.

Setup note: Ramp and BILL Spend & Expense add sophisticated budgeting and approval layers on top of corporate card programs, providing better spend control than traditional expense tools. For businesses evaluating comprehensive solutions, understanding AI bookkeeping automation can provide context on modern accounting capabilities.

4. Time Tracking & Project Management: QuickBooks Time, Harvest

Best for: Agencies, contractors, professional services firms, and any business billing clients hourly.

Why it matters: Syncs billable hours and project costs directly to QuickBooks for accurate client billing. QuickBooks Time offers advanced time tracking features with mobile capabilities and GPS verification.

Setup note: Eliminates manual timesheet entry and ensures accurate project profitability tracking.

5. Inventory Management: Shopify, Cin7 Core, SOS Inventory

Best for: Ecommerce operations, product-based SMBs, wholesalers, and businesses with complex inventory needs.

Why it matters: Links sales channels and stock tracking directly into QuickBooks. For e-commerce businesses, these integrations enable syncing order details from online stores and connecting multiple sales channels for real-time inventory visibility.

Setup note: Cin7 Core handles advanced features like manufacturing and batch tracking, while Shopify provides seamless integration for online retail.

6. Reporting & Forecasting: Fathom, Spotlight Reporting

Best for: CFOs, controllers, and fractional CFO services providers needing board-ready insights and investor reporting.

Why it matters: Transforms raw QuickBooks data into visual reports and financial forecasts, providing insights into cash flow trends and helping predict future financial performance.

Setup note: Fathom analyzes company health by examining cash flow and profitability trends, offering deeper understanding beyond basic financial statements. These tools integrate especially well with strategic finance workflows.

6b. Forecasting & Budgeting: Jirav, LivePlan, Float

Best for: CFOs, controllers, and fractional CFO services needing accurate forecasts for board decks, investor updates, or growth planning.

Why it matters: Financial forecasting tools connect directly to QuickBooks to transform static historical data into forward-looking budgets, cash-flow forecasts, and scenario plans. They automate the process of projecting revenue, expenses, and runway using live accounting data.

Popular tools:

- Jirav — connects to QuickBooks, Gusto, and Salesforce to create rolling forecasts and driver-based models.

- LivePlan — ideal for SMBs building budgets and funding plans tied to QuickBooks actuals.

- Float — offers real-time cash-flow forecasting directly from QuickBooks transactions.

Setup note: Choose a platform that supports driver-based modeling, multiple scenarios, and team collaboration so your forecasts stay dynamic and responsive as new data syncs in.

7. CRM & Sales: HubSpot, Salesforce

Best for: Sales-driven SMBs requiring pipeline-to-payment visibility and customer lifecycle tracking.

Why it matters: Connects revenue pipeline and customer data with accounting systems. Integrations enable finance teams to manage accounts receivable and follow up on outstanding invoices directly from CRM platforms.

Setup note: The Salesforce Connector by QuickBooks ensures consistent information between accounts, invoices, and payments, reducing errors and improving cross-departmental efficiency. CRM software integration provides comprehensive visibility into client interactions and financial flows.

8. Document Management: BILL, Dext

Best for: Businesses managing multiple vendors, remote bookkeeping teams, or complex approval hierarchies.

Why it matters: Streamlines accounts payable, bill payment workflows, and receipt capture. These tools automate AP processes and help manage vendor accounts efficiently.

Setup note: BILL allows customized workflows and routing rules for faster approvals and better spend control. The platform syncs invoices, customers, accounts, book balance, and vendors with QuickBooks for seamless data integration.

9. Tax Compliance Tools: Avalara, TaxJar

Best for: Multistate sellers, ecommerce businesses, and companies dealing with nexus in multiple tax jurisdictions.

Why it matters: Automates sales tax calculations, filing, and compliance across multiple jurisdictions, significantly simplifying tax season by handling complex rate changes.

Setup note: Reduces audit risk and eliminates manual sales tax calculations that are prone to costly errors.

10. Automation & AI Layers: Zapier, Omniga Finance OS

Best for: Businesses building a comprehensive Finance OS that scales efficiently without excessive manual intervention.

Why it matters: Connects QuickBooks to hundreds of apps and automates repetitive tasks across your technology stack. Zapier integration enables automated accounting by connecting disparate systems and ensuring seamless data synchronization.

Setup note: Unlike point-to-point automation tools, Omniga orchestrates your entire finance stack—centralizing review, reporting, and compliance into one intelligent platform that learns and improves over time.

Discover the future of automation in finance with the OCR boom ahead.

Ecommerce Integrations for Online Stores

For small business owners running online stores, integrating ecommerce platforms with QuickBooks Online integrations transforms financial operations. By connecting your Shopify store or leveraging Amazon Business Purchases, you automatically sync sales data, inventory levels, and customer information directly into accounting software.

Magento enables syncing sales and tracking inventory while creating invoices in QuickBooks Online when orders are created, further streamlining accounting processes. This seamless integration eliminates manual data entry, reduces errors, and frees valuable time.

Business processes become more efficient, and you maintain up-to-date financial data at all times. With these ecommerce integrations, small businesses can focus on growth and customer satisfaction, confident their accounting remains accurate and streamlined. For businesses exploring comprehensive technology solutions, understanding how to build a Finance OS provides valuable context for best practices for financial integration.

Data Entry Automation

Manual data entry creates significant bottlenecks for businesses, leading to wasted time and increased error risk. QuickBooks integration software offers powerful data entry automation tools that save time and improve accuracy significantly.

Apps available in the QuickBooks App Store, such as Transaction Pro Importer, allow importing data from Excel or CSV files directly into your account. Third-party apps like Webgility enhance automation by syncing ecommerce transactions automatically, eliminating repetitive tasks.

By automating data entry, businesses track expenses, manage inventory, and analyze financial data more efficiently, allowing teams to focus on higher-value strategic activities rather than manual processing. For businesses looking to implement intelligent document recognition, learn how to build your own OCR.

Amazon Business Purchases and Online Customers

The Amazon Business Purchases integration for QuickBooks simplifies accounting for small business owners who buy and sell on Amazon. This app automatically imports Amazon Business purchase transactions into QuickBooks, reducing manual entry and ensuring record accuracy.

Each transaction includes detailed information such as product descriptions, item costs, and fee breakdowns, making it easier to track sales tax obligations and manage online customer relationships effectively.

With this integration, businesses streamline accounting processes, maintain compliance, and gain better visibility into Amazon sales and expenses—all without manual data entry hassles. This automation proves particularly valuable during tax season and financial reviews.

Popular Apps for Productivity

Boosting productivity becomes straightforward when you connect popular apps to your QuickBooks Online account. Expensify automates expense tracking and reporting, while HubSpot brings powerful customer relationship management and sales automation features directly into your financial workflows.

Expensify's SmartScan technology imports receipt data into QuickBooks for approval, further simplifying expense management and reducing processing time. These integrations allow small businesses to manage financial data, customer records, and sales processes from unified platforms.

By integrating these popular productivity apps, businesses reduce manual data entry, improve business operations, and make smarter decisions based on real-time financial data. The result is more efficient workflows and stronger foundations for sustainable growth.

Multi-Entity and Consolidation Integrations

As businesses expand into multiple subsidiaries or locations, managing separate QuickBooks files can create data silos and manual consolidation headaches. Multi-entity reporting integrations solve this by aggregating results across entities automatically, eliminating spreadsheet roll-ups and ensuring consistent charts of accounts.

Popular consolidation tools: Fathom, Spotlight Reporting, and SaaSOptics (for subscription businesses) each connect directly to multiple QuickBooks instances, producing consolidated profit-and-loss statements, balance sheets, and cash-flow dashboards in minutes.

Best for: fractional CFOs, holding companies, and PE portfolio operators who require combined reporting and intercompany eliminations without migrating to NetSuite.

Implementation tip: When evaluating tools, confirm they support:

- Multi-currency conversion and intercompany eliminations

- Cross-entity KPIs and segment reporting

- Scheduled automated refreshes from each QuickBooks file

Integrated consolidation reporting gives finance leaders a single source of truth and accelerates month-end close across all entities.

How to Choose the Right QuickBooks Add-Ons for Your Business

When evaluating best QuickBooks integrations, consider these critical factors:

Business size and stage: Early-stage companies typically start with essential payments and payroll integrations, while growing firms layer on advanced reporting and automation tools as complexity increases.

Industry needs: Ecommerce operations demand robust inventory and tax tools, agencies prioritize time tracking and invoicing, while professional services focus on project management integration.

Setup complexity: Some add-ons offer plug-and-play simplicity, while others benefit significantly from QuickBooks consulting services for proper implementation and ongoing optimization.

Integration architecture: Consider how well tools communicate with each other beyond just connecting to QuickBooks individually.

Strategic tip: If you're searching for "QuickBooks bookkeeping services near me," carefully weigh the value of hiring implementation expertise versus managing integrations yourself. Professional guidance often pays for itself through time savings and avoiding costly mistakes. Understanding the broader context of small business bookkeeping software helps inform these decisions.

Common Challenges and Solutions

Small businesses using QuickBooks app integrations often face challenges like manual data entry, inventory management complexities, and integrating multiple sales channels effectively. Fortunately, the ecosystem offers comprehensive solutions to address these pain points.

Data entry automation apps eliminate repetitive tasks and reduce processing time significantly. Inventory management integrations like SOS Inventory provide real-time tracking and automated order fulfillment capabilities. Sales channel connectors ensure data from various platforms flows seamlessly into your accounting system without manual intervention.

By strategically leveraging these apps and integrations, small businesses streamline business processes, improve operational efficiency, and focus resources on growth rather than administrative tasks. The key lies in selecting tools that work together cohesively rather than creating new data silos.

Building a Finance OS with QuickBooks Integrations

The real power of integrations emerges when they work together cohesively—forming the backbone of a comprehensive Finance OS rather than disconnected point solutions.

Payments flow into QuickBooks automatically, triggering expense categorization rules and updating cash flow projections in real time.

Payroll syncs automatically with tax compliance tools and benefits administration, ensuring accuracy across all employee-related financial processes.

Reports pull unified data across sales, operations, and accounting, providing comprehensive visibility that supports strategic decision-making at every level.

Instead of juggling tools and manually reconciling data across platforms, orchestrate them into one cohesive system of record that provides complete financial visibility. This approach aligns with modern fractional CFO workflows and strategic finance best practices, and is ideal for businesses exploring what comes after QuickBooks.

For more guidance on building integrated financial workflows like a Finance OS, explore the Omniga Blog for insights on fractional CFOs, strategic finance, and bookkeeping.

Frequently Asked Questions

What are the best QuickBooks integrations for growing businesses?

The best QuickBooks integrations for growing businesses include payment processors like Stripe and Square, payroll tools like Gusto and ADP, expense management apps like Expensify and Ramp, time tracking tools like QuickBooks Time and Harvest, inventory systems like Shopify and Cin7 Core, reporting tools like Fathom and Spotlight Reporting, CRM platforms like HubSpot and Salesforce, document management solutions like BILL and Dext, tax compliance tools like Avalara and TaxJar, and automation platforms like Zapier and Omniga Finance OS.

How do QuickBooks integrations improve bookkeeping efficiency?

QuickBooks integrations improve bookkeeping efficiency by automating data entry, enabling real-time syncing between tools, reducing reconciliation errors, eliminating duplicate entry across apps, and providing centralized visibility into financial data. This automation saves time, reduces labor costs, and allows finance teams to focus on strategic activities rather than manual data processing.

Do I need QuickBooks consulting services to set up integrations?

Some QuickBooks add-ons offer plug-and-play simplicity and can be implemented without professional help, while others benefit from QuickBooks consulting services for proper setup and ongoing optimization. The need for consulting depends on your business size, technical expertise, integration complexity, and how many tools you're connecting. Professional guidance often pays for itself through time savings and avoiding costly configuration mistakes.

What is a Finance OS and how does it relate to QuickBooks integrations?

A Finance OS is a unified financial operating system that orchestrates multiple accounting and business tools into one cohesive platform. Instead of managing disconnected QuickBooks integrations separately, a Finance OS creates an interconnected ecosystem where payments flow automatically into QuickBooks, payroll syncs with tax compliance, and reports pull unified data across sales, operations, and accounting. This orchestration approach provides complete financial visibility and strategic insights beyond what individual integrations can deliver.

Which QuickBooks integrations are essential for ecommerce businesses?

Essential QuickBooks integrations for ecommerce businesses include inventory management tools like Shopify, Cin7 Core, or SOS Inventory for real-time stock tracking; payment processors like Stripe or Square for transaction automation; tax compliance tools like Avalara or TaxJar for multistate sales tax management; and sales channel connectors that automatically sync order details from online stores. These integrations eliminate manual data entry and provide up-to-date financial data across all sales platforms.

How much do QuickBooks integrations cost?

QuickBooks integration costs vary widely depending on the tool and your business needs. Some basic integrations are free, while others range from $10-50 per month for small business plans to $100-500+ per month for enterprise solutions with advanced features. Payment processors typically charge transaction fees rather than monthly subscriptions. When budgeting, consider both subscription costs and implementation time, as some integrations require setup assistance from QuickBooks bookkeeping services or consulting professionals.

Can QuickBooks integrate with budgeting and forecasting tools?

Yes. Apps such as Jirav, LivePlan, and Float connect directly to QuickBooks to automate budgeting, forecasting, and scenario planning. These integrations pull real-time accounting data to create rolling forecasts, cash-flow projections, and variance reports, giving finance leaders continuous visibility into future performance.

Can QuickBooks handle multi-entity consolidations and reporting?

While QuickBooks itself manages one entity per file, integrations such as Fathom, Spotlight Reporting, and SaaSOptics enable consolidated reporting across multiple QuickBooks companies. These tools automate intercompany eliminations, multi-currency adjustments, and combined dashboards, giving finance leaders portfolio-level visibility without manual spreadsheets.

Conclusion: From Apps to Orchestration

QuickBooks integrations can transform bookkeeping from reactive record-keeping to strategic financial management. However, stitching together numerous apps still leaves gaps in visibility, control, and strategic insight without proper orchestration.

That's where Omniga provides unique value. We serve as the orchestration layer that unifies your QuickBooks apps into one comprehensive Finance OS—with intelligent automation, strategic oversight, and actionable insights built directly into the platform.

Rather than managing disconnected tools, Omniga creates a cohesive financial infrastructure that learns from your business patterns and continuously improves operational efficiency.

👉 Discover how Omniga makes QuickBooks integrations work together seamlessly