Fractional CFO Pricing: What to Expect and How to Budget

Learn what a fractional CFO costs. Compare hourly rates, monthly retainers, and pricing models to budget for your business.

Table of Contents

Introduction

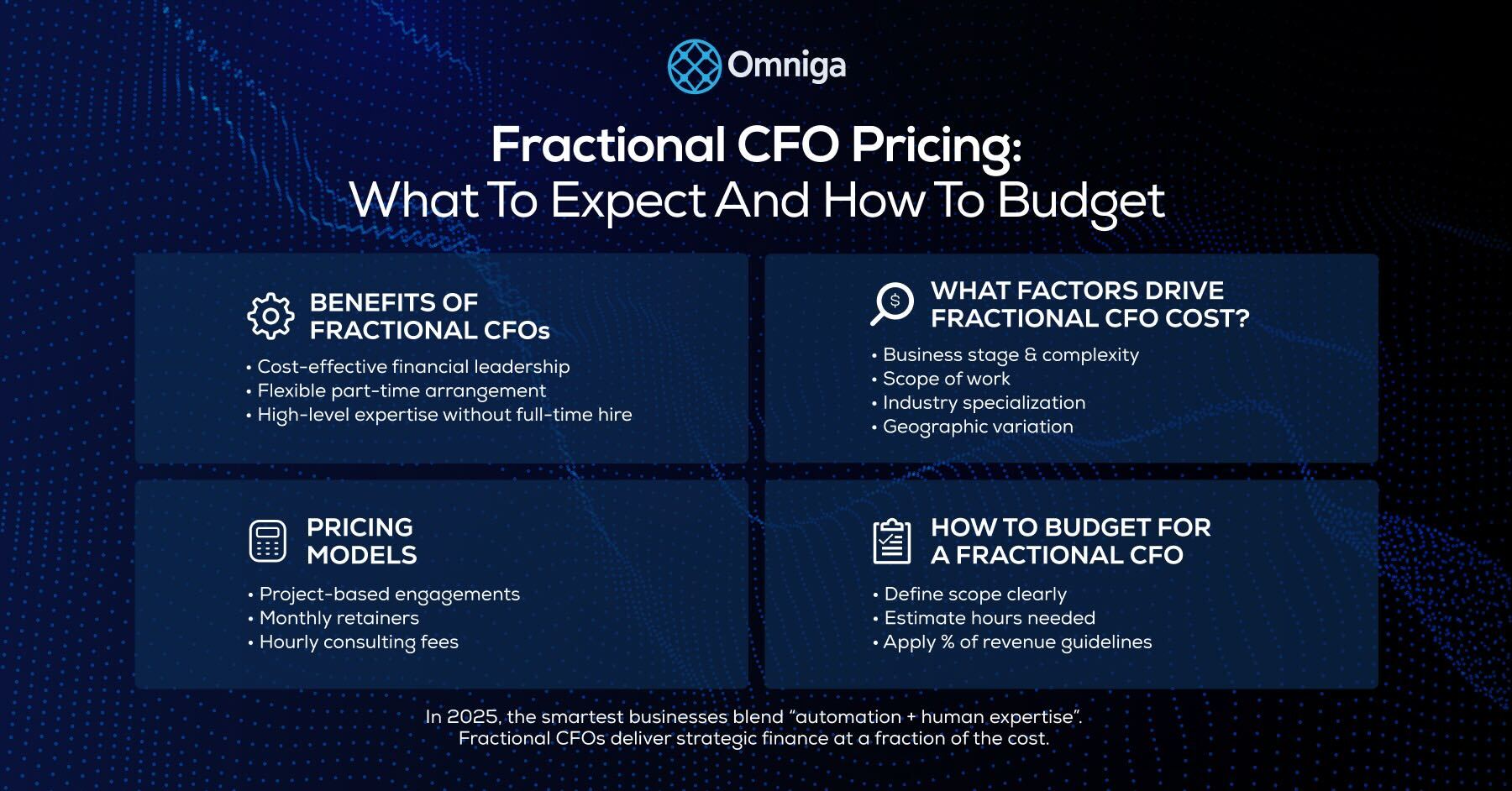

Hiring a CFO doesn't have to mean committing to a six-figure salary and a full-time executive. Fractional CFO pricing models provide expert financial leadership without requiring a full time commitment, making them a flexible alternative to a full time hire or house CFO. Increasingly, businesses are turning to fractional CFO services—flexible, part-time arrangements that provide high-level financial strategy at a fraction of the cost.

Startups often find that their financial needs do not justify the expense of a full-time CFO, making fractional CFO cost structures a suitable option. Small businesses can hire a fractional CFO to gain strategic value and oversight of the company's finances without the overhead of a full time hire. But what does a fractional CFO cost? How should you budget, and how do fractional CFO rates compare to other models like virtual, part-time, or outsourced CFOs?

This guide breaks down fractional CFO hourly rates, pricing models, and benchmarks so you can confidently plan for the right level of support. If you're still weighing your options, read our full guide to what is a fractional CFO (And When Should You Hire One?).

Introduction to Fractional CFO Services

Fractional CFO services offer small and mid-sized businesses access to high-level financial expertise without the commitment or expense of hiring a full-time chief financial officer. A fractional CFO works on a part-time or project basis, providing targeted support to address specific financial challenges and drive long-term financial health.

By hiring a fractional CFO, companies can benefit from expert financial guidance in areas such as cash flow management, financial operations, and strategic planning—without the overhead of a full-time CFO. This cost-effective option is ideal for businesses seeking to optimize their financial strategy, improve cash flow, and make informed decisions that support sustainable growth.

According to McKinsey research, AI is transforming how fractional CFOs deliver services, enabling them to serve more clients efficiently while reducing costs. Whether your business needs help with financial reporting, budgeting, or navigating complex financial decisions, fractional CFO services deliver the high-level expertise needed to strengthen your company's financial foundation.

Benefits of Fractional CFOs

Hiring a fractional CFO brings a range of benefits that can make a significant difference for small businesses and growing companies. One of the most compelling advantages is cost savings—fractional CFO rates provide the expertise of a seasoned financial executive at a fraction of the cost of a full-time CFO, with fractional CFO hourly rates typically ranging from $200 to $350.

This lower-cost, flexible model allows businesses to access specialized knowledge and industry-specific experience that might otherwise be out of reach. Fractional CFOs can enhance financial health by improving financial reporting, developing robust financial models, and implementing effective cash management strategies.

Their strategic finance guidance helps companies navigate unexpected challenges, refine their business strategy, and make data-driven decisions. The rise of AI-powered fractional services is making these engagements even more efficient and cost-effective. For small businesses that don't require a full-time CFO, hiring a fractional CFO is a smart way to gain high-level financial oversight and support, all while maintaining budget flexibility and focusing resources where they matter most.

What Factors Drive Fractional CFO Cost?

Several factors influence the cost of hiring a fractional CFO, with the factors influencing pricing including the scope, complexity, and specific business needs. Not all CFO engagements are priced the same. A few key variables determine what you'll pay:

Business stage & complexity: Early-stage startups may need help with fundraising or cash runway, while a $20M+ SMB may require complex FP&A and multi-entity consolidations. More complexity often leads to higher fractional CFO fees.

Scope of work: Is this a one-off project (e.g., building a financial model), or are you engaging for specific projects such as acquisitions, capital raises, or audits? Project based pricing is common for these defined, high-stakes initiatives, and the scope and complexity of such projects are major cost drivers.

Industry specialization: A fractional CFO's experience and industry expertise can lead to higher fractional CFO rates, especially when hiring experienced fractional CFOs with deep SaaS, eCommerce, or regulated industry backgrounds, as they often command premium rates.

Geographic variation: A CFO in New York or San Francisco will likely cost more than one in a smaller market, though remote-first models are blurring these lines.

Other important variables include how many hours a CFO works, your budget constraints, and the opportunity cost of using internal resources for financial management instead of leveraging external expertise. The integration of modern inance technology and AI accounting tools is also changing how fractional CFOs price their services.

Ultimately, optimizing cash flow, supporting your business's financial health, and driving your company's growth and financial growth are key outcomes that justify the investment in a fractional CFO.

Fractional CFO Services: What's Included?

Fractional CFO services encompass a broad range of financial activities designed to strengthen a company's financial operations and support its growth objectives. Typical services include financial oversight, preparation and analysis of financial reports, and the development of forward-looking financial strategies.

Fractional CFOs also assist with budgeting, forecasting, and cash flow management, ensuring that businesses have the reliable data and insights needed to make informed decisions. For companies seeking to raise capital, fractional CFOs can provide fundraising support and guidance throughout the process.

Each engagement is tailored to the business's unique needs, which may involve in-depth analysis of current financial systems and identifying opportunities for improvement. By leveraging high-level financial expertise, fractional CFOs help businesses optimize their operations, achieve their financial goals, and position themselves for long-term success.

Qualifications and Experience: How They Impact Pricing

The qualifications and experience of a fractional CFO play a significant role in determining CFO for hire pricing. Fractional CFOs with specialized knowledge or deep industry-specific expertise often command higher fractional CFO hourly rates, sometimes ranging from $300 to $500 per hour.

Those with a proven track record of supporting small to mid-sized businesses are particularly valuable, as they understand the unique challenges and opportunities these companies face. The cost of a fractional CFO also depends on the scope of services required—basic financial oversight will generally be less expensive than a comprehensive engagement involving strategic planning, financial modeling, or fundraising support.

When hiring a fractional CFO, it's important to consider both the level of expertise and the specific services your business needs. Robert Half research shows that CFOs with technology fluency and AI experience are increasingly in demand. By evaluating these key factors, you can ensure you're investing in the right financial partner to drive your company's growth and financial health.

Fractional CFO Pricing Models Explained

The pricing model for fractional CFOs can vary, with options including monthly retainer, hourly rate model, flat monthly fee, fixed monthly fee, and project-based pricing. Fractional CFO rates are structured in a few common ways:

Project-based engagements

Best for discrete needs (e.g., fundraising model, due diligence, or ERP selection). Typical fractional CFO fees: $5,000–$20,000 per project.

Monthly retainers

This is the most common pricing model. It provides predictable hours (e.g., 20–40 hours/month) and can be structured as a flat monthly fee or fixed monthly fee for cost certainty and ongoing support. CFO for hire pricing: $3,000–$15,000 per month, depending on scope and stage.

Hourly consulting fees

The hourly rate model is flexible and often used for advisory or interim work. Fractional CFO hourly rates vary depending on the fractional CFO's experience, the scope of engagement, and client needs. Fractional CFOs charge different rates based on these factors. Typical fractional CFO hourly rate: $150–$350/hr (some specialists may charge more).

What Are Typical Fractional CFO Hourly Rates?

To make it concrete, here are the ranges you'll usually see for fractional CFO fees:

- Hourly: $150–$350/hr

- Monthly retainers: $3K–$15K/month

- Project-based: $5K–$20K

By comparison, a full-time CFO salary (plus benefits) often exceeds $250K–$400K/year according to Journal of Accountancy compensation insights—making fractional arrangements especially attractive for growing businesses.

How Do Fractional CFO Costs Compare to Other Options?

There's often confusion between different "CFO for hire" terms. Here's how fractional CFO fees compare:

Part-time CFO cost: Essentially another term for fractional. Usually priced the same ($150–$350/hr, $3K–$15K/month).

Virtual CFO cost: Often overlaps with fractional CFO, but "virtual" emphasizes remote delivery. Rates are typically $3K–$10K/month for SMBs. (See our full breakdown: Fractional CFO vs Virtual CFO comparison guide).

Outsourced CFO cost: Usually provided by a firm rather than an individual. Bundled with accounting or bookkeeping services, costs range from $2K–$8K/month, depending on package.

Full-time CFO cost: $250K+ in salary, plus equity and benefits—rarely viable before $50M+ in revenue.

For businesses evaluating temporary vs ongoing CFO support, our guide on interim CFO firms vs fractional CFO explains cost differences and engagement models, with interim CFOs costing $20K-$40K/month for crisis management versus fractional CFOs at $5K-$15K/month for strategic growth support.

Average CFO Cost for Small Businesses

Small businesses often face budget constraints, making it important to choose a pricing model that fits their needs and supports their company's finances. For SMBs in the $1M–$20M revenue range, average spend falls into these benchmarks:

Startups ($1M–$5M revenue): $3K–$7K/month, often tied to fundraising prep or board reporting. Many startups prefer a flat monthly fee or fixed monthly fee structure, which provides predictable costs and helps manage expenses within budget constraints.

Growing SMBs ($5M–$20M revenue): $7K–$12K/month, with deeper involvement in forecasting, lender relations, and system upgrades. Opting for a flat monthly fee or fixed monthly fee can help these businesses plan for financial growth and maintain cost certainty as their needs evolve.

Mature businesses ($20M+ revenue): $12K–$15K/month or more, sometimes blended with in-house controller/finance staff.

A useful rule of thumb: many companies budget 1–2% of revenue for finance leadership, scaling up as complexity increases. The integration of AI in accounting and finance operations is enabling fractional CFOs to deliver more value at these price points and challenging the traditional finance staffing models.

Who This Is For / When It's Worth It

Fractional CFO pricing makes sense when you need strategic financial leadership but aren't ready for a full-time hire. However, if your books are a mess, you'll get more value by cleaning them up first. Consider QuickBooks cleanup services or our QuickBooks cleanup SOP to get your financial foundation in order before engaging a fractional CFO.

If you really just need ongoing bookkeeping rather than strategic finance leadership, bookkeeping services pricing may be a more cost-effective starting point. Bookkeeping services typically cost $500–$2,000/month, while fractional CFOs start at $3K/month and focus on forward-looking strategy rather than transaction processing.

How to Budget for a Fractional CFO

Here's a framework for mapping CFO for hire pricing to your business stage:

Define scope clearly. Is this a fundraising sprint, ongoing board prep, or full finance oversight? Budgeting for specific projects, such as acquisitions or financial audits, may require a different approach than ongoing support.

Estimate hours needed. Consider how many hours are required—light-touch engagement may be 10 hours/month; a heavier one, 40+. Factor in the opportunity cost of allocating internal resources to these tasks versus other priorities.

Apply benchmarks. Multiply expected hours by typical fractional CFO hourly rates ($150–$350) or retainer bands ($3K–$15K).

Use % of revenue guidelines. Under $5M in revenue? Stay closer to 1%. Over $10M? Budget up to 2–3%.

Plan to increase spend. As you scale, CFO support becomes more strategic (capital allocation, M&A, international expansion). Understanding the evolution of finance operations and technology can help you plan for these expanding needs.

In summary, a fractional CFO can act as a strategic partner to support your business's financial health while delivering measurable ROI through improved financial processes and strategic decision-making.

FAQs on Fractional CFO Pricing

What's the average fractional CFO hourly rate?

Most fall between $150–$350/hr, with specialists charging more based on their expertise and industry experience.

How much does a fractional CFO cost per month?

Expect $3,000–$15,000/month, depending on scope and stage. Early-stage companies typically invest $3K–$7K monthly, while mature businesses may spend $12K–$15K+.

Is a fractional CFO cheaper than a full-time CFO?

Yes—fractional CFO fees are often 25–50% of a full-time CFO's total compensation, making it an attractive option for growing businesses.

What's the difference between fractional and outsourced CFO costs?

Fractional usually means an individual executive hired part-time. Outsourced often refers to a firm bundling CFO + bookkeeping/accounting services, sometimes at a lower monthly rate but with less strategic focus.

The Bottom Line

Fractional CFO pricing varies, but most businesses spend $3K–$15K/month or $150–$350/hr depending on needs. Compared to the cost of a full-time CFO, it's a lean way to access senior finance expertise without overextending your budget.

At Omniga, we believe modern finance leaders deserve tools that make fractional engagements even more efficient. Whether you're a startup preparing for a raise or an SMB scaling past $10M, our platform helps you extend CFO capacity while staying lean.

👉 Explore Omniga's pricing or explore our fractional CFO resource hub for deeper insights.