Fractional CFO vs Outsourced Accounting: How to Choose

Fractional CFO or outsourced accounting? Compare costs, key differences, and how to choose the right finance model for your business.

Table of Contents

Introduction

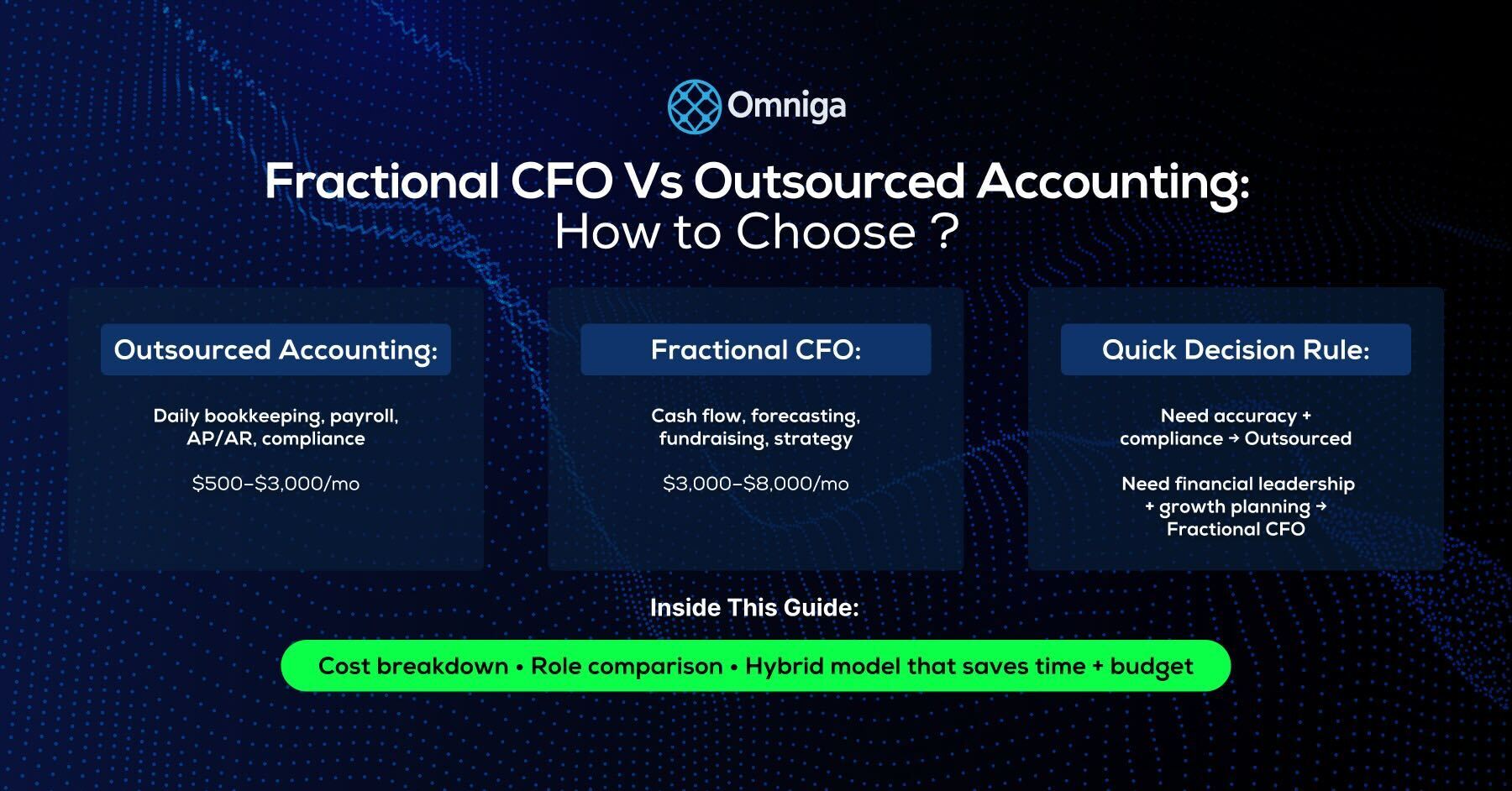

The line between outsourced accounting services and fractional CFO support is often blurred for growing companies. Both offer flexible, cost-effective solutions, and outsourced accounting services can serve as a cost-efficient alternative to maintaining an in-house accounting department. However, the outcomes they deliver are fundamentally different.

For founders exploring the strategic side of finance leadership, our full guide on what is a fractional CFO breaks down responsibilities, pricing models, and when businesses typically make the switch from pure execution to strategy.

If you're a founder, SMB owner, or finance leader deciding between these models, the key question is simple: Do you need execution, strategy, or both?

Outsourcing also allows companies to focus on their core business, allocating resources and attention to their main operations and strategic growth. Additionally, outsourcing provides timely financial reporting, which is essential for decision-making.

Choosing between these options can seem like a daunting task for business owners, especially with the challenges of evolving technology and finding the right provider. In this guide, we'll define each model, compare costs and scope, and show how some companies combine both approaches for maximum impact.

What Are Outsourced Accounting Services?

Outsourced accounting services involve hiring an external provider—usually a firm or software-enabled platform—to manage your day-to-day financial operations, which often include essential back office tasks. These services are suitable for a wide range of businesses, from startups to established companies, and typically cover the entire accounting function.

Outsourcing the accounting function can streamline financial processes, ensure compliance, and provide strategic insights. The provider, often referred to as a company, acts as an external partner, and outsourced accountants are external professionals who deliver these services.

Typical services include:

- Bookkeeping (transaction categorization, reconciliations)

- Payroll management

- Accounts payable and receivable

- Financial statement preparation

- Compliance support (sales tax, 1099s, etc.)

Bookkeeping is one of the primary services of outsourced accounting firms, ensuring that financial records are accurate and up-to-date. Many providers also offer setup of a customized chart of accounts tailored to your business needs.

Well-known outsourced accounting firms and companies include Bench Accounting, Pilot, and Big 4-backed providers that scale to enterprise needs.

When to use outsourced accounting:

- Your business is a small business or early-stage company

- You mainly need accurate books and compliance

- Cost efficiency is more important than deep strategic insight

This model reduces overhead by shifting fixed headcount costs to a monthly subscription or service fee. Cost considerations include flexible hourly rates or fixed monthly packages when choosing an outsourced accounting service, allowing businesses to select a pricing model that aligns with their financial needs and operational scale.

Outsourced accounting is especially valuable for organizations with limited resources that need to maximize efficiency while maintaining accurate financial records.

What Is a Fractional CFO?

A fractional CFO is a senior finance leader who works part-time or on contract, offering the same strategic oversight as a full-time CFO—without the six-figure salary.

Unlike outsourced accounting firms, a fractional CFO focuses on strategic finance, not just transactions. They also deliver advisory services to support process improvement and internal controls. For companies evaluating different finance roles, understanding the distinctions outlined in our CFO vs Controller vs Bookkeeper guide can help clarify which expertise level your business truly needs.

Key responsibilities include:

- Forecasting and financial modeling

- Fundraising and investor reporting

- Strategic planning (pricing, growth, M&A readiness)

- Cash flow optimization

- Board and lender communication

Fractional CFOs for startups ensure your business receives relevant information for better decision-making and implement streamlined processes to improve efficiency. They serve as strategic partners who translate financial data into actionable business intelligence.

What Is the Main Difference Between Outsourced Accounting and Fractional CFO Services?

This is the most important distinction to understand: outsourced accounting services focus on execution and compliance, handling day-to-day financial operations like bookkeeping, payroll, and financial statement preparation. These services keep your financial records accurate and ensure you meet regulatory requirements.

Fractional CFO services provide strategic financial leadership including forecasting, fundraising support, investor reporting, and strategic planning. While outsourced accounting keeps your books accurate, fractional CFOs turn financial data into strategic business decisions that drive growth and profitability.

According to McKinsey’s Finance 2030 research, leading finance teams shift work from transactions to value-added activities (FP&A, strategic planning, treasury) and reimagine the operating model to build new skills and decision speed—spending about 19% more finance time on value-added work than a typical function did a decade ago.

Comparing Fractional CFOs and Outsourced Accounting Firms

Here's how the two models stack up:

| Category | Outsourced Accounting Firms | Fractional CFOs |

|---|---|---|

| Scope of Work | Bookkeeping, payroll, compliance, reporting | Forecasting, fundraising, strategy, financial leadership |

| Cost | $500–$3,000/month (varies by complexity) | $150–$400/hour, or $3K–$8K/month depending on engagement |

| Best Fit | Early-stage SMBs, startups needing clean books | Scaling companies, PE-backed firms, or those raising capital |

| Decision Drivers | Cost savings, accuracy, automation | Strategic insight, capital planning, leadership |

Both models address different layers of the finance stack—execution versus leadership. Outsourced accounting firms give you access to an entire team of finance professionals, using a team approach that can flexibly support businesses across many industries.

How Much Do Outsourced Accounting Services Typically Cost?

Outsourced accounting services typically cost between $500 and $3,000 per month, depending on your business complexity and service scope. This usually includes bookkeeping, payroll management, accounts payable and receivable, financial statement preparation, and basic compliance support.

The cost structure can be hourly rates or fixed monthly packages. Understanding fractional CFO pricing helps you budget appropriately for strategic finance leadership while keeping execution costs predictable. The key is matching your investment to your actual needs—execution versus strategic guidance.

Data Security and Compliance Considerations

When outsourcing your accounting functions, data security and compliance should be at the top of your priority list. Entrusting sensitive financial data to an external provider means you need confidence that your information is protected and that all regulatory requirements are met.

What Data Security Measures Do Outsourced Accounting Firms Provide?

Leading outsourced accounting firms use advanced cloud-based solutions with encryption, firewalls, and strict access controls to protect sensitive financial data. They provide secure, real-time access to your financial information while maintaining compliance with industry regulations and data protection standards.

With features like multi-factor authentication, role-based permissions, and audit trails, these systems are designed to safeguard your financial operations against cyber threats and unauthorized access. Cloud-based accounting services also provide access to financial data from anywhere, at any time, enhancing flexibility and operational efficiency.

Their teams of experienced professionals stay current with evolving regulatory requirements including tax laws and financial reporting standards. The use of cloud technology in accounting has revolutionized how businesses manage compliance while maintaining robust security protocols.

Compliance is another critical area where outsourced accounting firms excel. By understanding your unique accounting needs, these firms can tailor their services to address specific compliance challenges, whether it's managing accounts receivable, accounts payable, or preparing accurate financial statements. Additionally, outsourced accounting firms leverage AI-driven insights to enhance financial efficiency and decision-making, providing businesses with a competitive edge.

One of the key benefits of partnering with an outsourced accounting firm is the ability to access specialized expertise without the overhead of maintaining a full in-house accounting team. This allows your business to focus on core operations and strategic planning, while the outsourced team handles the day-to-day accounting processes and provides reliable financial information for informed business decisions.

When evaluating potential outsourced accounting firms, it's essential to review their data security protocols, compliance procedures, and experience within your industry. Firms with industry specialization can offer valuable insights and customized solutions that align with your business goals.

Ongoing support, expert guidance, and consulting services from these professionals can help streamline your accounting processes, improve financial management, and increase productivity as your business grows. Equally important is ensuring that the outsourced accounting providers demonstrate a good cultural fit with your company, as this alignment can enhance collaboration and long-term success.

By outsourcing your finance and accounting functions to a trusted partner, you gain access to a team of professionals dedicated to protecting your financial data, ensuring compliance, and supporting your long-term success. This strategic approach not only delivers cost savings and efficiency but also empowers your business to make informed decisions and drive sustainable growth.

Can You Use Both Together?

Yes—and many companies do. This hybrid model leverages outsourced finance solutions instead of building a full internal accounting team, allowing businesses to access specialized expertise and advanced technology without the overhead of hiring and managing an internal team.

Can I Use Both Outsourced Accounting and a Fractional CFO Together?

Yes, many companies successfully use a hybrid model combining both services. In this approach, the fractional CFO sets strategic direction including budgets, KPIs, and cash flow planning, while the outsourced accounting firm executes daily transactions and compliance tasks.

The CFO then reviews the outsourced outputs to ensure accuracy and strategic alignment, creating an effective orchestration layer that keeps the finance function aligned with business goals. This combination is particularly effective when AI accounting software handles routine tasks, freeing the CFO to focus on high-value strategic initiatives.

Benefits of combining both:

- CFO sets the direction (budgets, KPIs, cash flow runway)

- Outsourced firm executes the transactions (bookkeeping, payables, reconciliations)

- CFO reviews outsourced outputs to ensure accuracy and strategic alignment

Think of it as an orchestration layer: the CFO keeps the outsourced team aligned with the company's growth goals. This model directly addresses the challenges highlighted in Why AI Will Accelerate the Growth of Fractionalized Services, where technology enables fractional leaders to effectively manage multiple execution teams.

How to Decide What's Right for Your Business

Ask yourself these key questions:

- Do we mainly need compliance and clean books → outsource accounting.

- Are we preparing for fundraising, scale, or board oversight → hire a fractional CFO.

- Do we want both execution and leadership without hiring in-house → hybrid model.

The best choice depends on the unique challenges and goals of your business. Measuring fractional CFO ROI helps quantify the strategic value beyond basic bookkeeping costs.

When Should a Small Business Hire a Fractional CFO Instead of Just Outsourcing Accounting?

A small business should consider hiring a fractional CFO when they are seeking capital or navigating rapid growth, lack financial visibility for strategic decision-making, need help with KPIs and financial modeling, require investor or board reporting, or are preparing for M&A activities.

If your primary need is accurate books and compliance, outsourced accounting may be sufficient. If you need strategic financial leadership to guide business decisions, a fractional CFO is the better choice.

Signs you need outsourced accounting services:

- You're behind on books or payroll

- Your team lacks bandwidth for transaction work

- Compliance risk is rising

The benefit of outsourced accounting services is that they help businesses address these challenges by providing cost savings, increased efficiency, compliance support, and better financial decision-making.

How Do I Know If My Business Needs Strategic Finance Leadership?

Your business likely needs strategic finance leadership from a fractional CFO if you are preparing for fundraising rounds, experiencing rapid growth that requires cash flow planning and resource allocation decisions, need to communicate financial performance to investors or a board of directors, require complex financial modeling and forecasting, or are evaluating major business decisions like pricing strategy, expansion, or acquisitions.

These activities require strategic thinking beyond basic accounting compliance. For companies exploring the distinction between similar service models, our comparison of Fractional CFO vs Virtual CFO clarifies how engagement structures differ beyond just the execution versus strategy divide.

Conclusion

Outsourced accounting firms keep your books accurate and compliant. Fractional CFOs turn numbers into strategy. Together, they form a lean finance team that can scale with your business. These solutions are effective across a wide range of industries, supporting sectors such as manufacturing, engineering, consulting, and more.

If you're weighing both options, remember: you don't need to choose one forever. Many companies start with outsourcing, then layer in a fractional CFO as complexity grows. The modern finance stack is modular, as explored in What Comes After QuickBooks, allowing you to assemble the right mix of tools and talent as your needs evolve.

Ready to see how a fractional CFO could help your business scale? Explore more in our fractional finance series or connect with our team for a consultation.