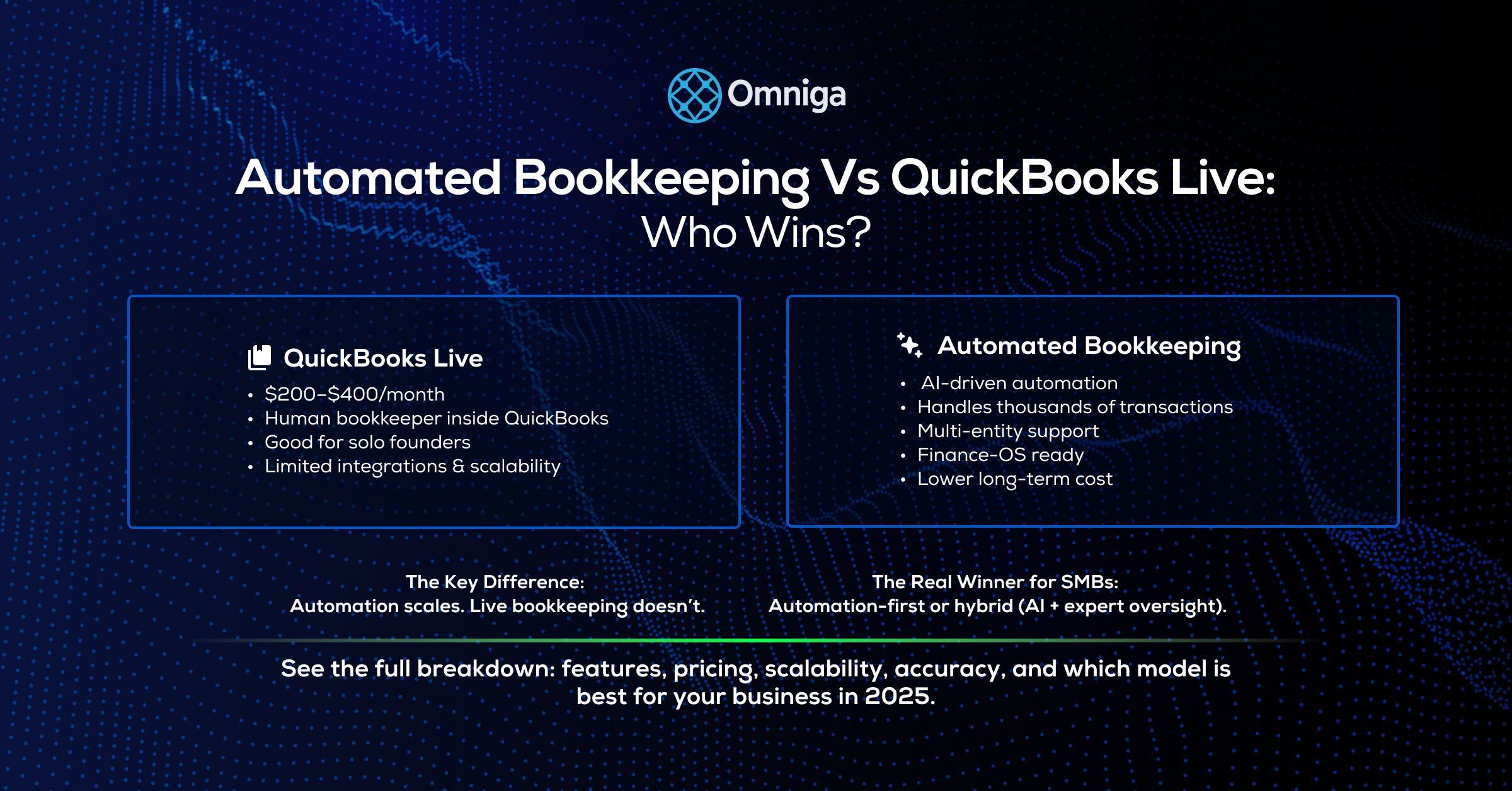

Automated Bookkeeping vs QuickBooks Live: Who Wins?

Compare automated bookkeeping software and QuickBooks Live costs, features, and scalability. Discover which bookkeeping solution best fits growing SMBs.

Table of Contents

Introduction

For small and growing businesses, bookkeeping feels like a never-ending grind. QuickBooks Live promises relief by pairing you with a human bookkeeper inside QuickBooks, while automated bookkeeping software uses AI and machine learning to categorize, reconcile, and even forecast transactions with minimal human input.

If you're still exploring the broader shift toward automation-first accounting stacks, our comprehensive guide to the future of best accounting software and QuickBooks alternatives explains how AI is reshaping the Finance OS. Before replacing QuickBooks, consider best QuickBooks integrations that can extend functionality with payment processors, expense management, and reporting tools.

So—should you lean on QuickBooks Live's human-assisted approach, or go all in on automation? Let's break it down. The right choice depends on your business's growth stage and which solution will best support your scaling operations.

What Is Automated Bookkeeping Software?

Automated bookkeeping software uses AI-driven rules, pattern recognition, and integrations to handle the bulk of bookkeeping tasks. Instead of manually coding expenses or hiring a bookkeeper to do it, the system learns from transaction history, vendor data, and rules you set. This approach can help ensure accurate record-keeping from the business incorporation date, making it easier to reconcile accounts from the company's formation.

When evaluating automated bookkeeping software, consider your favorite tools and features, such as user-friendliness and cloud-based accessibility. Most accounting automation tools are cloud-based, allowing users to access their financial data from anywhere, which is especially beneficial for remote work and on-the-go management.

How Automated Bookkeeping Works

Transaction categorization: AI assigns expenses and income to chart of accounts automatically.

Bank reconciliation: Connects directly to your account and uses account statements to match bank feeds with invoices, bills, or receipts, ensuring accuracy. Automated bookkeeping software can integrate with multiple banks and credit cards, allowing for seamless syncing and reconciliation of transactions from various sources. However, QuickBooks Live has reconciliation limitations—it relies on manual bookkeeper review rather than automated matching. For businesses needing more robust reconciliation workflows, QuickBooks reconciliation services provide dedicated support to reconcile bank and credit card accounts in QBO efficiently.

Learning engine: Improves over time as you review or correct entries, becoming more accurate with each transaction.

Integrations: Syncs with AP, payroll, CRM, and reporting tools to create a unified financial ecosystem.

Common Automated Bookkeeping Tools

Examples include Pilot, Bench Accounting, Botkeeper, and emerging platforms like Omniga, which combine automation with oversight inside a Finance OS. Some automated bookkeeping software options also offer free plans or features, making them accessible for startups and small businesses.

Automation fits naturally into a modern Finance OS, where AP, payroll, reporting, and forecasting all pull from a single source of truth. For startups establishing their financial foundation, our guide on bookkeeping for startups explains how to set up systems from day one. Some automated bookkeeping software platforms also integrate with human resources functions, providing features such as payroll management and administrative support.

What Is QuickBooks Live?

QuickBooks Live is Intuit's subscription service that pairs QuickBooks Online with access to a live bookkeeper. A QuickBooks Live Bookkeeper provides real-time support, but does not offer all the services of a full-service accounting firm. While QuickBooks Live connects you with a bookkeeper, it does not replace the expertise of an accountant or CPA for advanced financial analysis, tax planning, or business strategy. Instead of replacing bookkeeping with automation, it bolts on a human resource to maintain your books.

QuickBooks Live Cost

As of 2025, QuickBooks Live pricing (per Intuit's official pricing) is:

$200/month for businesses under $10k monthly expenses

$300/month for $10k–$50k expenses

$400/month for $50k+ expenses

These costs are for QuickBooks Live only; you must also pay for a QuickBooks Online subscription, as paying for Live is in addition to the costs of the required QuickBooks Online plan.

Where QuickBooks Live Fits

Best for solo operators who want reassurance from a human bookkeeper when starting out.

Works if your business needs are straightforward and you're already on QuickBooks.

Limited integration beyond QuickBooks—hard to scale into a broader Finance OS. QuickBooks Live is best suited for businesses whose business needs do not require complex integrations.

Bookkeeping Tasks: What's Involved?

Bookkeeping is the backbone of any small business's financial health. At its core, bookkeeping involves recording, categorizing, and reconciling every financial transaction that flows through your business—whether it's income, expenses, assets, liabilities, or equity. For small business owners and accounting firms alike, these tasks are essential for maintaining accurate and up-to-date financial records, which in turn support smarter business decisions.

Typical bookkeeping tasks include entering data from invoices and receipts, tracking expenses, and reconciling bank and credit card accounts to ensure your records match your actual account balances. This process can be time-consuming, especially when done manually, and increases the risk of errors that can impact your financial statements. That's why many businesses turn to accounting software like QuickBooks Online, which streamlines data entry, automates transaction categorization, and helps you stay organized.

By adopting efficient bookkeeping practices and leveraging the right tools, business owners can reduce the burden of manual data entry, keep their accounts accurate, and generate reliable financial statements. Whether you're managing a handful of transactions or overseeing a growing business, having a solid bookkeeping process in place is key to staying on top of your accounting and making informed decisions for your business's future.

Features and Integration: How Do They Stack Up?

For small business owners, the right accounting software isn't just about crunching numbers—it's about how well it fits into your daily operations. QuickBooks Online stands out for its seamless integration with bank accounts and credit card accounts, allowing you to automatically import transactions and keep your cash flow up to date without the hassle of manual data entry. This level of accounting automation means you can manage your bookkeeping practices more efficiently, freeing up time to focus on growing your business.

QuickBooks Live bookkeeping takes it a step further by providing real-time data entry and categorization, so your books stay accurate and current. This reduces the risk of errors and ensures you always have a clear picture of your business's financial health. Some automated bookkeeping software also allows you to easily share reports and financial data with team members or external advisors, improving collaboration and transparency.

For established businesses looking for more robust features, platforms like Bench offer comprehensive tools for expense tracking, accounts payable, and generating detailed financial statements—all designed to automate bookkeeping and support your business as it scales. According to Gartner's research on digital finance transformation, automation within core accounting platforms is becoming a critical differentiator for finance leaders.

When choosing accounting software, consider how well it integrates with your existing systems, such as invoicing, purchase order management and receipt tracking tools. The best solutions offer seamless integration, making it easy to manage accounts, automate repetitive tasks, and access real time data. Ultimately, the right fit will help you streamline your bookkeeping, improve accuracy, and support your business's unique needs.

Security and Support: What You Need to Know

When it comes to managing your business's finances, security and support are non-negotiable. QuickBooks Online is designed with small business owners in mind, offering advanced encryption and two-factor authentication to safeguard your sensitive financial data. Automated bookkeeping software also provides strong encryption and security measures to protect sensitive financial information from cyber threats. For a deeper look at how modern platforms maintain enterprise-grade data safety, explore Omniga’s security and data protection standards.This means you can manage your accounting tasks with confidence, knowing your information is protected against unauthorized access.

QuickBooks Live bookkeeping adds another layer of reassurance by giving you access to a team of certified bookkeepers. Whether you have questions about your books or need help navigating a tricky tax situation, you can count on expert support tailored to your business's needs. However, QuickBooks Live is not a full-service accounting solution and lacks features like financial planning advice.

Other accounting software, like Digits, also prioritize security with bank-grade encryption and offer multiple support channels—including email, phone, and online resources—to ensure you always have help when you need it. For businesses requiring strategic oversight beyond basic bookkeeping, fractional CFO services provide expert financial guidance without full-time overhead.

As a small business owner, it's important to evaluate both the security features and the quality of support offered by your accounting software. Look for solutions that provide robust data protection, easy access controls, and responsive customer service. This will help you manage your bookkeeping, file taxes, and create budgets with peace of mind, knowing your business's financial data is in safe hands.

Time-Saving Benefits: Automation vs Live Bookkeeping

For small businesses, time is money—and the right bookkeeping approach can help you save both. Automation, powered by accounting software like QuickBooks Online, takes the hassle out of repetitive tasks such as data entry, transaction categorization, and bank account reconciliations. By connecting directly to your bank accounts, automation tools can import and categorize transactions in real time, generate reports, and even handle invoicing, freeing up valuable hours for business owners to focus on growth and strategy.

On the other hand, QuickBooks Live Bookkeeping offers the advantage of real-time support from certified bookkeepers. These professionals can help you manage your books, provide tax advice, and ensure your records are accurate and up to date. This human touch is especially valuable when you need guidance on complex transactions or want reassurance that your accounts are in order.

By combining automation with live bookkeeping, small business owners can streamline their accounting workflows, reduce the risk of errors, and improve cash flow management. Whether you prefer the efficiency of automation or the personalized support of a live bookkeeper, both approaches help you spend less time on bookkeeping and more time driving your business forward.

For more details, see the case study ‘Small Business Automates Invoicing Process’ showing how automation can streamline bookkeeping.

Key Differences Between Automation and QuickBooks Live

| Factor | Automated Bookkeeping Software | QuickBooks Live | Hybrid (Automation + Expert Oversight) |

|---|---|---|---|

| Cost | Subscription, often $150–$500/month; scales with transaction volume | $200–$400/month flat | Software cost + fractional oversight |

| Scalability | Handles thousands of transactions, multi-entity | Manual labor limits scalability | Balances automation with CFO/bookkeeper review |

| Accuracy | AI-driven, improves over time; requires review rules | Dependent on assigned bookkeeper; includes Accurate Books Guarantee | High accuracy through automation + expert checks |

| Workflow Integration | Connects AP, payroll, reporting, forecasting | Limited to QuickBooks ecosystem | Finance OS-ready |

| Future-Readiness | Built for long-term automation | Stopgap solution tied to legacy software | Forward-looking with flexibility |

| Full Service Bookkeeping | Varies by provider; may include financial statement and balance sheet preparation | QuickBooks offers full service bookkeeping, including professional bookkeeper assignment, bank account connection, transaction categorization, financial statement and balance sheet preparation, trial balance, and closing books | Depends on provider; may include expert oversight and closing support |

QuickBooks offers full service bookkeeping with features such as an Accurate Books Guarantee and preparation of a trial balance as part of their closing process. For businesses evaluating service models, understanding the difference between fractional CFO vs virtual CFO services can inform your decision-making process.

Full Service Bookkeeping: When You Need More

As your business grows, so do your accounting needs. Full service bookkeeping is designed for small businesses that require more than just basic transaction tracking. This comprehensive approach includes everything from preparing financial statements and managing accounts payable to creating budgets and developing a tax plan. Full service bookkeeping ensures your records are accurate, your expenses are tracked, and you're ready for tax time—without the stress.

For small business owners, investing in full service bookkeeping means gaining access to expert support that can automate bookkeeping tasks, integrate your accounting software with other business systems, and help you manage your accounts more efficiently. This level of service is especially valuable when your business faces increased complexity, such as higher transaction volumes or the need for detailed financial reporting.

By choosing full service bookkeeping, you not only improve your accounting practices but also gain insights that can lead to cost savings and smarter business decisions. With a dedicated team handling your bookkeeping, you can focus on what matters most: growing your business and achieving your goals. According to Deloitte's analysis of AI in finance operations, hybrid models combining AI with human oversight are emerging as the most effective approach.

Pros and Cons of Automated Bookkeeping Software

Pros

Scales with your business—no per-hour limits or capacity constraints.

Reduces human error and manual data entry through intelligent automation.

Frees up finance teams for strategy and high-value activities.

Connects seamlessly into a Finance OS with AP, payroll, and forecasting tools.

Helps you manage your money more efficiently by automating financial processes.

Allows you to track and invoice customers, making customer management easier.

Makes it easy to generate detailed reports for monitoring KPIs, tracking expenses, and making informed decisions.

Users of automated bookkeeping solutions often report increased confidence in the accuracy of their bookkeeping.

Cons

May misclassify unusual transactions during initial learning phase.

Setup and review process needed initially to train the system.

Some platforms still require light human intervention for edge cases.

Pros and Cons of QuickBooks Live

Pros

Direct human support from certified bookkeepers available on demand.

Predictable pricing tiers based on monthly expense volume.

Works inside QuickBooks—no new software to learn if you're already using it.

Helps with tracking sales and integrating sales data into your bookkeeping.

Cons

Limited scalability; bookkeeper time doesn't grow with transaction load.

Higher cost relative to automation over time as your business grows.

Doesn't integrate into AP, payroll, or forecasting workflows outside QuickBooks.

Dependent on one bookkeeper—service consistency can vary between assignments.

Business Owners' Needs: Matching Solutions to Your Goals

No two small businesses are exactly alike, and your accounting software should reflect your unique goals and challenges. If you're a small business owner with limited accounting experience, QuickBooks Online offers an intuitive interface and automated features like invoicing and receipt tracking, making it easy to stay on top of your finances without a steep learning curve.

For businesses experiencing rapid growth or dealing with more complex financial operations, a platform like Bench can be a game-changer. Learn how to cut processing time by 80% with your own OCR accounting software to handle complex financial operations efficiently. With advanced features such as accounts payable management, detailed financial statements, and seamless integration with your bank accounts, you can handle everything from bank transfers to expense tracking with ease. This level of functionality is especially valuable as your annual revenue increases and your business's accounting needs become more sophisticated.

When evaluating accounting software, consider your current business stage, the volume of transactions, and the expertise of your team. Think about how the software will help you save time, ensure accurate books, and support your business's growth. By aligning your choice with your specific needs—whether it's robust reporting, easy bank integration, or streamlined expense management—you'll be better equipped to manage your accounts and drive your business forward with confidence. For more details on how automated bookkeeping is transforming small business accounting, see The OCR Boom Ahead: Automated Bookkeeping for SMBs.

For startups just beginning their financial journey, refer to our comprehensive bookkeeping for startups guide for day-one setup strategies.

Which Option Is Best for SMBs?

The right choice depends on your stage and goals and how well the solution fits your small business needs:

Solo founders: QuickBooks Live may feel safer when every dollar counts, but you'll hit limits quickly as transaction volume grows.

Growing SMBs: Automated bookkeeping software handles larger volumes and integrates with payroll, invoicing, and reporting systems across your tech stack.

Fractional CFOs and finance managers: Hybrid models combining automation with oversight offer scalability and controls. Learn more about fractional CFO pricing to understand cost structures, or see how Omniga supports fractional teams.

That's why many businesses graduate from QuickBooks Live to automation-first solutions once they cross $500k–$1M in revenue or manage multi-entity operations.

Final Verdict — Which Wins?

Is automated bookkeeping software better than QuickBooks Live? For most growing businesses, yes. Automated bookkeeping software offers superior scalability, seamless integration with modern finance tools, and lower long-term costs. QuickBooks Live works well for solo founders seeking human reassurance, but lacks the workflow integration and capacity needed for scaling operations. The optimal approach combines AI automation (handling 90% of routine tasks) with expert oversight for exceptions and strategic decisions.

If your goal is future-ready finance, automated bookkeeping software wins on scalability, integration, and long-term cost efficiency. QuickBooks Live provides a safety net, but it's best seen as a bridge—not the destination.

Hybrid models are emerging as the sweet spot: AI automation does 90% of the heavy lifting, while experts handle exceptions, oversight, and strategic reporting. According to McKinsey research on AI transformation, businesses combining automation with expert oversight achieve the best outcomes.

Ready to modernize your bookkeeping? Explore Omniga's Finance OS or view pricing and plans to see how we combine AI automation with expert oversight.

While both solutions can help you prepare your records for tax return filing and make tax time easier, they do not replace personalized tax advice or a comprehensive tax plan from a qualified professional. For legal, business, or tax-related matters, always consult a licensed advisor.

Frequently Asked Questions

What is the difference between automated bookkeeping software and QuickBooks Live?

Automated bookkeeping software uses AI and machine learning to categorize transactions, reconcile accounts, and process financial data with minimal human intervention. QuickBooks Live pairs you with a human bookkeeper who works inside QuickBooks Online to maintain your books. Automated software scales better with transaction volume, while QuickBooks Live provides human expertise at flat monthly rates.

How much does QuickBooks Live cost in 2025?

QuickBooks Live pricing in 2025 is $200 per month for businesses under $10k in monthly expenses, $300 per month for $10k-$50k expenses, and $400 per month for over $50k expenses. These costs are in addition to your required QuickBooks Online subscription.

Which is more scalable: automated bookkeeping or QuickBooks Live?

Automated bookkeeping software is significantly more scalable as it can handle thousands of transactions and multi-entity operations without capacity constraints. QuickBooks Live's scalability is limited by bookkeeper availability and time, making it less suitable for high-growth businesses with increasing transaction volumes.

Can automated bookkeeping software integrate with other financial tools?

Yes, automated bookkeeping software typically integrates with AP automation, payroll systems, CRM platforms, and reporting tools to create a unified Finance OS. QuickBooks Live is limited to the QuickBooks ecosystem and doesn't offer the same level of workflow integration across multiple platforms.

What is the best bookkeeping solution for growing SMBs?

Growing SMBs typically benefit most from automated bookkeeping software or hybrid models that combine AI automation with expert oversight. These solutions scale with transaction volume, integrate with other business systems, and provide long-term cost efficiency. QuickBooks Live works best for solo founders or very small businesses with straightforward needs.

Are hybrid bookkeeping models better than fully automated or human-only approaches?

Hybrid models combining AI automation with expert oversight are emerging as the optimal approach. AI handles 90% of routine tasks like categorization and reconciliation, while human experts manage exceptions, provide strategic oversight, and ensure accuracy. This delivers the efficiency of automation with the judgment and quality control of experienced professionals.

Is QuickBooks Live worth the cost for small businesses?

QuickBooks Live is worth the cost for solo founders and very small businesses with straightforward bookkeeping needs who value human support. However, at $200-$400 per month plus QuickBooks Online subscription costs, businesses planning to scale beyond $1M revenue should consider automated bookkeeping software or hybrid models that offer better long-term value, scalability, and integration with modern finance tools.

Can I switch from QuickBooks Live to automated bookkeeping software?

Yes, switching from QuickBooks Live to automated bookkeeping software is straightforward since your data remains in QuickBooks Online. Most automated bookkeeping platforms integrate directly with QuickBooks, allowing you to maintain your existing ledger while adding AI-powered automation for categorization, reconciliation, and reporting. The transition typically takes 2-4 weeks to configure rules and train the system on your transaction patterns.