Outsourced vs In-House Bookkeeping: What's Best for SMBs?

Compare outsourced bookkeeping vs in-house hiring for small businesses. Cost analysis, pros & cons, decision framework for choosing the right approach.

Table of Contents

Introduction

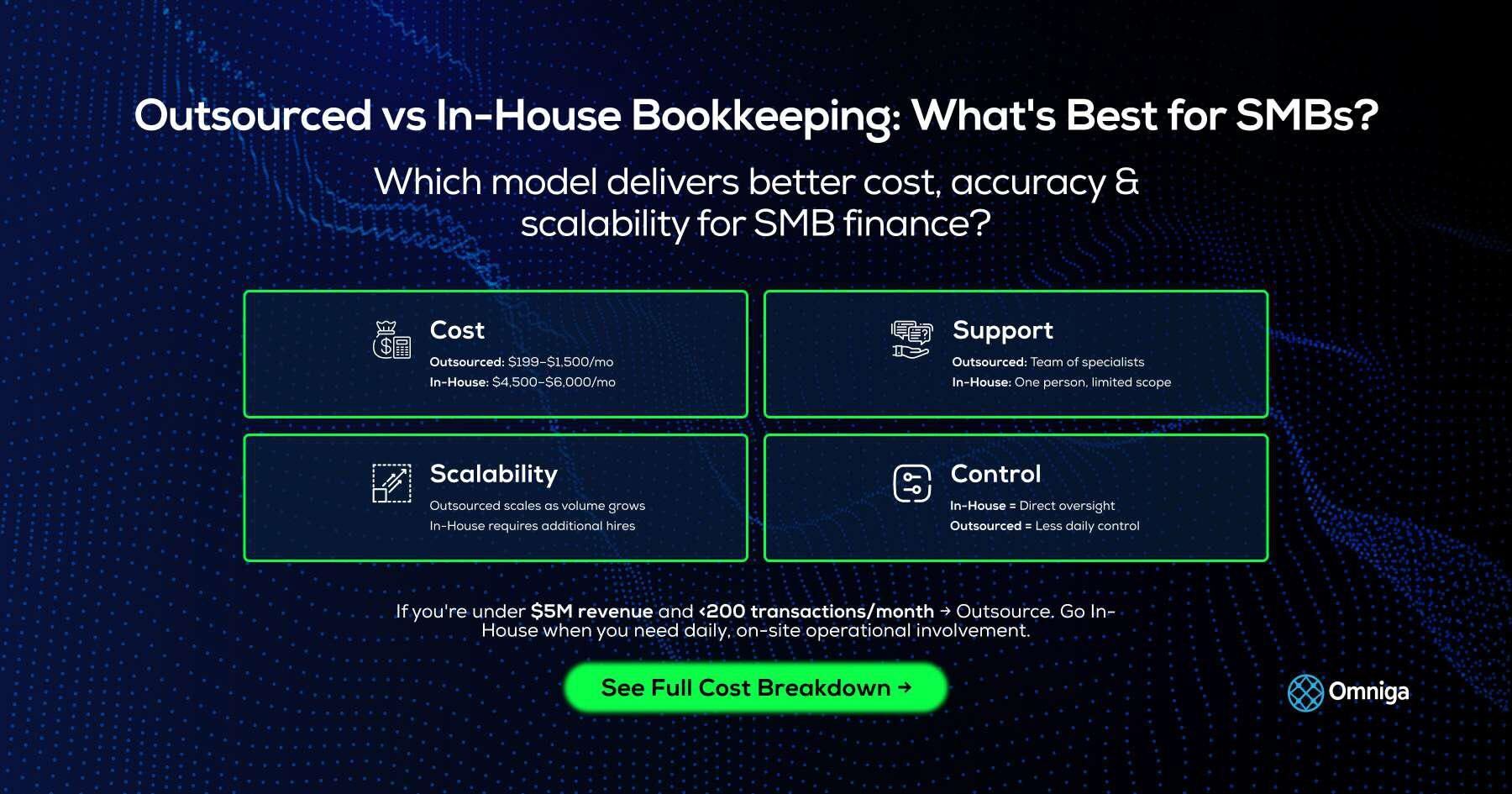

For small and growing businesses, deciding between outsourced bookkeeping, building an internal accounting department, or an in-house hire can feel like a fork in the road. The choice impacts not only your monthly costs, but also how quickly you get decision-ready financials, how scalable your finance function is, how much risk you carry, and how well your solution fits your specific business needs.

We'll compare outsourced bookkeeping services vs in-house bookkeeping, including costs, pros & cons, and when to outsource bookkeeping as you scale.

Quick answer: For SMBs, outsourced bookkeeping usually delivers the same quality at 30–50% lower cost than hiring in-house. Expect $199–$1,500+/mo outsourced vs $4.5k–$6k/mo fully loaded in-house. Go in-house when you need constant, on-site support or have complex, multi-entity operations.

In this comprehensive guide, we'll break down both approaches, compare costs, and provide a decision framework to help you choose the right path for your business stage and requirements.

What Is Outsourced Bookkeeping?

Outsourced bookkeeping means hiring an external provider—an outsourced bookkeeping service, freelancer, or specialized outsourced bookkeeping company—to handle your financial recordkeeping. This approach allows businesses to delegate accounting tasks to external experts while maintaining oversight of their financial operations. For new businesses, understanding the basics of bookkeeping for startups can make it easier to decide whether outsourcing is the right fit.

Typical Scope of Services

Modern outsourced bookkeeping solutions typically include:

- Recording transactions and categorizing expenses

- Reconciling bank and credit card accounts

- Managing accounts payable (AP) and accounts receivable (AR)

- Payroll coordination and processing

- Financial reporting and tax-ready books

- Using advanced accounting software for efficient operations- with many firms now offering AI bookkeeping automation to save time and reduce errors.

How Outsourced Bookkeeping Works

Freelancers: Solo bookkeepers engaged on an hourly or project basis, ideal for simple bookkeeping needs.

Firms/companies: Teams of professionals that offer comprehensive outsourced bookkeeping solutions with tiered bookkeeping outsourcing services and manage your books with specialized expertise.

Platforms: Tech-enabled providers that blend automation with human review, delivered through online platforms where you work with virtual bookkeeping services. These services often include an online account for clients to access their financial data and reports remotely, as well as tools to streamline AP/AR tasks, including purchase orders.

According to Deloitte research, 63% of businesses outsourcing their accounting have experienced improvements in financial accuracy and efficiency, highlighting the strategic value of professional outsourced bookkeeping services.

In-House Bookkeeping Explained

An in-house bookkeeper is an employee on your payroll, either part-time or full-time. Their responsibilities typically include daily transaction entry, vendor and customer communications, expense categorization, and generating reports for internal teams.

Understanding In-House Limitations

Most in-house bookkeepers focus on data entry and reconciliations, not higher-level tasks like forecasting or tax planning. As your business scales, adding a controller or CFO layer may still be necessary to handle strategic financial functions.

Hiring a full-time bookkeeper also incurs additional costs such as benefits and overhead, which can significantly increase the overall expense compared to outsourcing alternatives.

Cost Comparison: Outsourced vs In-House

Outsourced bookkeeping cost (2025): $199–$500/mo (small), $600–$1,500/mo (growing), $2,000+/mo (controller oversight). In-house cost (2025): ~$4,500–$6,000/mo fully loaded (salary, benefits, taxes, tools).

Understanding the true cost difference is crucial for making an informed decision about your bookkeeping approach. If you’re already behind on your books, see our guide on bookkeeping cleanup services.

In-House Bookkeeping Costs

According to the U.S. Bureau of Labor Statistics, the median annual wage for bookkeepers is $49,210 (approximately $4,100/month). However, this base salary doesn't tell the complete story:

- Add 20–30% for benefits, payroll taxes, and overhead

- Software subscriptions (QuickBooks, payroll tools) add $50–$300/month

- Office space, equipment, and training costs

- Risk of turnover and replacement hiring costs

All-in, most SMBs should budget $4.5k–$6k/month for in-house, inclusive of benefits and overhead.

Outsourced Bookkeeping Costs

Outsourced bookkeeping service pricing offers more predictable and often more affordable options:

- Entry-level services start around $199–$500/month for small businesses

- Growing companies typically pay $600–$1,500/month depending on transaction volume and complexity

- Premium providers with controller-level oversight can exceed $2,000/month

For detailed pricing breakdowns, see our comprehensive guide on bookkeeping services pricing.

Cost Comparison Summary

| Factor | Outsourced Bookkeeping | In-House Bookkeeping |

|---|---|---|

| Monthly Cost | $199–$1,500+ | $4,500–$6,000 (incl. benefits) |

| Expertise | Varies, firm-based teams often broader | One person's skillset |

| Scalability | Flexible by package | Requires new hires |

| Tools/Software | Often included | Business pays separately |

| Overhead | None | Office, HR, payroll costs |

At a glance: Outsourced = scalable, multi-specialist team, tools included; less direct control. In-house = immediate access, cultural fit; highest cost and single-point dependency.

Note: Most providers scale pricing with transaction volume; costs rise quickly beyond ~200 txns/month.

Pros and Cons of Outsourcing Bookkeeping

Advantages of Outsourced Bookkeeping

Scalability: Easy to upgrade packages as your business grows, especially relevant for small business owners managing expanding operations.

Expertise: Access to teams of specialists, not just one bookkeeper. This includes exposure to industry best practices and diverse client experiences. Intuit Research

Cost efficiency: Typically 30-50% lower than hiring full-time staff, according to industry research. Total cost is typically 30–50% lower than in-house for comparable output.

Tech stack included: Many firms provide automation, dashboards, and integrations that would be expensive to implement independently.

Relief from daily tasks: Outsourcing means getting relief from day-to-day bookkeeping, allowing your staff to focus on higher-value work and core business activities.

Business growth focus: Delegating bookkeeping lets you focus on growing your business and nurturing client relationships rather than managing financial paperwork. When evaluating virtual bookkeeping services, consider how they compare to software-only solutions to ensure you're choosing the right approach for your business needs.

Disadvantages of Outsourced Bookkeeping

Less control: Limited direct oversight of day-to-day processes.

Dependency: Reliant on vendor's quality, processes, and availability.

Security concerns: Sharing sensitive financial data externally requires careful vetting of security protocols. CPA Practice Advisor

It's essential to make sure you select a reputable and secure provider to protect your business interests and financial data.

Pros and Cons of In-House Bookkeeping

Advantages of In-House Bookkeeping

Direct control: Full oversight of processes and immediate access to financial information.

Team integration: Bookkeeper sits close to operations and understands company culture intimately.

Real-time access: Immediate support for ad-hoc needs and urgent financial questions.

Disadvantages of In-House Bookkeeping

High cost: Salary plus benefits far exceed outsourcing costs, often 2-3x more expensive.

Limited expertise: Risk of "one-person dependency" and narrow skill development.

Turnover risk: Replacing staff disrupts continuity and requires significant time investment in hiring and training.

Scalability challenges: Adding team members requires significant planning and budget increases.

How to Decide: Outsourced vs In-House

Choosing the right approach depends on several key factors specific to your business situation.

Decision Factors

Rule of thumb: If you're <$5M revenue and <200 transactions/month, outsource. Move to hybrid or in-house when you require daily on-site support, heavy multi-entity accruals, or strict internal controls.

Complexity: Multi-entity operations or industry-specific compliance requirements may benefit from a hybrid approach combining outsourced services with internal oversight.

Control vs flexibility: Determine whether immediate control or operational flexibility matters more at your current growth stage.

Decision Matrix by Business Stage

| Business Stage | Recommended Approach |

|---|---|

| Startup (<$1M revenue) | Outsourced bookkeeping service |

| Growth ($1M–$5M) | Outsourced + part-time controller |

| Scale ($5M–$20M) | Hybrid (in-house bookkeeper + outsourced firm for overflow/review) |

| Established ($20M+) | Primarily in-house team, but many firms still use outsourced specialists or hybrid support beyond this point |

When to Switch: Switch from outsourced to in-house (or hybrid) when you pass $20M+ revenue, need real-time internal coordination, or must maintain continuous, audit-ready controls across multiple entities.

This framework aligns with industry trends where 70% of small and medium businesses outsource some portion of their accounting needs.

As your company grows, consider adding hybrid structures—combining outsourced bookkeeping with part-time controllers or fractional CFOs.

Choosing an Outsourced Bookkeeping Provider

When selecting an outsourced bookkeeping company or evaluating a bookkeeping outsourcing service, focus on these critical factors:

Qualities to Look For

- Proven experience in your industry and business size

- Transparent bookkeeping services outsourcing packages with clear pricing

- Secure tech stack with audit trails and data protection protocols

- Integration capabilities with QuickBooks, Xero, or your preferred software

- Access to higher-level guidance (controller/CFO expertise when needed)

- Advanced technology usage, such as AI-powered tools and up-to-date accounting software for efficient and secure operations

Users should verify the credentials and experience of a bookkeeping service before hiring to ensure they meet specific business needs.

Red Flags to Avoid

- No clear pricing structure or hidden fees

- Poor security practices or lack of data protection certifications

- Absence of references or industry credibility

- Limited technology capabilities or outdated software

For more detailed guidance, explore our comprehensive resource on outsourced virtual bookkeeping services for startups and SMBs.

Modern Trends in Bookkeeping Solutions

The bookkeeping landscape is evolving rapidly, with several key trends reshaping how businesses approach financial management:

AI and Automation Integration

Modern outsourced bookkeeping providers increasingly leverage artificial intelligence and automation to improve accuracy and reduce costs. This trend mirrors broader changes in the future of accounting software, where AI-powered tools are becoming standard.

Hybrid Service Models

Many successful businesses are adopting hybrid approaches that combine the benefits of both outsourced and in-house capabilities. This might include outsourced bookkeeping with periodic fractional CFO oversight for strategic guidance. BlueWave

Focus on Strategic Value

The evolution toward strategic finance means that businesses are looking beyond basic bookkeeping to providers that can offer insights and guidance for growth decisions.

Final Recommendation for SMBs

For most small businesses, outsourced bookkeeping provides a better balance of cost, expertise, and scalability than hiring in-house. For SMBs, outsourced bookkeeping often matches in-house quality while saving businesses 30–50% on cost versus hiring in-house. The data strongly supports this approach:

- Cost savings of 30-50% compared to in-house alternatives

- Access to specialized expertise and modern technology

- Flexibility to scale services as business grows

- Reduced administrative burden of managing employees

As your company grows, consider adding hybrid structures—combining outsourced bookkeeping with part-time controllers or fractional CFOs. This approach provides the strategic oversight needed for larger operations while maintaining cost efficiency.

The Role of Modern Technology

Modern providers use automation and AI to reduce manual work, improve accuracy, and deliver decision-ready books faster. This technological advancement addresses many traditional concerns about outsourcing, such as speed and accuracy of financial reporting.

Clear communication and reporting expectations with your bookkeeping provider are essential for ensuring a smooth and effective working relationship.

Next Steps for Your Business

Ready to streamline your books and focus on growth? The decision between outsourced and in-house bookkeeping should align with your business stage, budget, and strategic priorities.

Consider outsourcing if you:

- Want to reduce costs while maintaining quality

- Need access to specialized expertise

- Prefer flexible, scalable solutions

- Want to focus on core business activities

Consider in-house if you:

- Require immediate, constant access to bookkeeping staff

- Have complex, highly specialized needs

- Have the budget for full-time employees plus benefits

- Prefer direct control over all financial processes

Try Omniga free Omniga product to see how our modern outsourced bookkeeping solution combines AI, automation, and expert oversight to deliver the benefits of both approaches—advanced technology with personalized service.

Frequently Asked Questions

How much does outsourced bookkeeping cost in 2025?

Outsourced bookkeeping costs typically range from $199-$500/month for small businesses, $600-$1,500/month for growing companies, and $2,000+/month for premium services with controller-level oversight. Pricing depends on transaction volume, complexity, and service level requirements.

Is outsourced bookkeeping cheaper than in-house?

Yes, outsourced bookkeeping is typically 30-50% cheaper than in-house alternatives. While in-house bookkeepers cost $4,500-$6,000/month including salary and benefits, outsourced bookkeeping services provide similar quality at $199-$1,500/month with additional technology and expertise included.

When should a business switch from outsourced to in-house bookkeeping?

Businesses should consider switching to in-house bookkeeping when they reach $20M+ revenue, have complex multi-entity operations requiring constant oversight, or need immediate daily access to bookkeeping staff. However, many successful companies maintain outsourced bookkeeping even at larger scales by using hybrid models.

What's included in a typical outsourced bookkeeping service?

Most bookkeeping outsourcing services include transaction recording, bank reconciliations, accounts payable/receivable management, payroll coordination, financial reporting, and tax-ready books. Premium outsourced bookkeeping companies also provide controller-level oversight, advanced reporting, and strategic guidance.

How do I choose between different outsourced bookkeeping companies?

When evaluating outsourced bookkeeping companies, look for industry experience, transparent pricing, secure technology, software integrations, and access to higher-level expertise. Verify credentials, check references, and ensure they use modern bookkeeping outsourcing technology that scales with your business needs. For more tips, insights, and resources, visit our Bookkeeping Hub to explore everything you need to make the right choice for your business.